BOOK NOW

〰️

BOOK NOW 〰️

Schedule an appointment

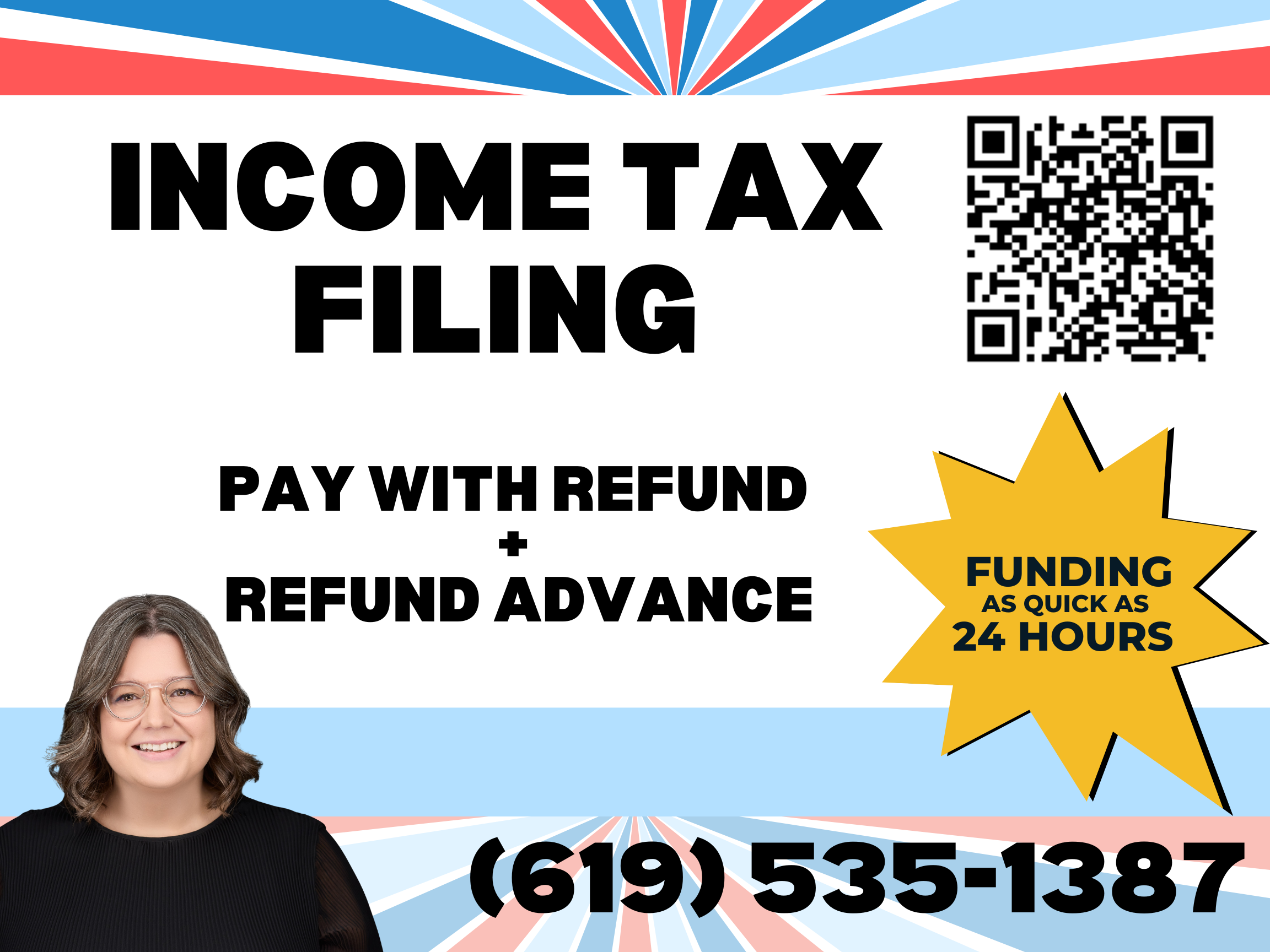

Book your appointment with Britt Harwood, licensed tax preparer and owner of Our Place Financial. In this 30 minute meeting, we’ll discuss your tax return filing. We’ll also go over pay with your refund & refund advance options.

During this meeting we can also do a free refund estimate.

Virtual Meetings available on Zoom and In-Person appointments available in Irvine, CA.

2. Send us your tax return information

We utilize a secure and convenient client portal to exchange information and process payments. You’ll complete a new client questionnaire and upload your tax documents. The sooner you send us the information, the sooner we can get your return processed.

In the questionnaire, be sure to select 'pay with your refund’ and ‘refund advance’ options if you’re interested in those.

We’ll review and let you know if anything additional is needed.

3. We get to work

Once your tax return information is submitted, we will have your tax return complete within 72 hours.

If you’ve selected to apply for a refund advance we will submit the application with our bank partner, Refund Advantage. Approvals are issued within hours and funding is as fast as next day.

Refund advance fees are only charged if approved. Interest-free advances of up to $1,000 and up to $7,000 interest-bearing advances are available.

What you’ll get

-

✺

Knowledgable and supportive tax preparation

-

✺

Answers to all your tax questions

-

✺

Accurate, simple, and quick tax filing

-

✺

No upfront costs (pay with your refund)

-

✺

Up to $7,000 refund advance

-

✺

Relief as you cross taxes off your to-do list

✺ Frequently Asked Questions ✺

-

Our bank partner Refund Advantage charges fees only if approved and funded. Interest-free advances of up to $1,000 and interest-bearing advances of up to $7,000 are available.

Interest is only charged on days between advance funding and the day the IRS sends the funds to the bank partner with a max of 60 days. -

up to $7,000.

-

Yes, there is a tax filing fee that is owed when we file your taxes.

You can pay with your refund OR pay in advance.

-

Step 1 is to schedule an appointment with us to begin your tax return filing. It’s okay if you don’t have all of your documents (like W-2s) yet.

-

We can do free refund estimate with your final paystub but actual W-2 forms are required to file taxes and apply for the advance.